[ad_1]

Spotify technology (New York Stock Exchange: Spot) is currently on a path where it seems impossible for the company to achieve profitability. Nonetheless, the music-streaming giant’s stock has consistently hit 52-week highs, reflecting unwavering optimism from investors who may have overlooked the potential roadblocks ahead. ing. Specifically, Spotify’s stock price is up about 84% year-to-date, but the company’s recent performance has been perhaps worrying, with delayed earnings and wider losses.

In my opinion, Spotify investors will eventually have to wake up from all the delusions currently driving the stock up and face the undeniable truth that the company cannot achieve profitability. Therefore, I am bearish on equities.

Issues Spotify Investors Ignore

A central issue that Spotify investors seem to be ignoring is the lack of profitability prospects inherent in the company’s business model. Spotify’s streaming model offers value to both consumers and (to a lesser extent) artists, but falls short when it comes to meeting the financial interests of its shareholders, as its margins are narrow.

A major component of Spotify’s cost of goods sold is centered around the hefty royalties paid to artists and record labels, eroding the company’s bottom line significantly, leaving only a meager gross margin. In its latest Q1 results, Spotify once again demonstrated this challenge, with its gross margin declining slightly to 25.2% from 25.3% in the previous quarter. This single figure alone shows that companies have little room to generate profits once the added costs are taken into account.

In fact, considering Spotify’s heavy spending on R&D, marketing, administration, etc., which amounted to a staggering €922 million, it surpassed the company’s gross profit of $766 million over the same period. That is clear. As a result, Spotify reported a disappointing operating loss of €156 million in the same quarter.

Growth prospects don’t look promising either

A compelling argument for Spotify’s bulls revolves around the company’s growth story, suggesting profit margins could improve as the platform and its subscriber base grow. This could reverse the negative trend in Spotify’s financial situation.

However, I find this argument very difficult to support. First, it’s worth noting that Spotify has already achieved significant scalability. The company’s user base of more than 515 million monthly active users (MAUs), including 210 million premium subscribers, saw modest Q1 growth of 5% and 2%, respectively . As a result, Spotify is about to reach a user plateau and further expansion will pose significant challenges.

But even if the user base continues to grow, Spotify’s business model doesn’t allow it to take advantage of the expanded profits, as mentioned above. Each additional user will incur a corresponding copyright fee based on their listening time, further increasing Spotify’s expense burden and matching current profit margins.

While other streaming-on-demand platforms like Disney+, Hulu, and HBO Max allow you to produce a TV show once and squeeze incremental benefits from your user base at no additional cost, Spotify does just that. There is no such basic perk. Unlike the inherent stability most services enjoy, Spotify’s financial prospects are likely to continue to be hampered by the ever-increasing loyalty that accompanies its growing user base.

The advertising business does not add any added value

Another potential positive catalyst for Spotify’s investment deal, which could address the limitations of its current business model, is in its advertising business. This segment explicitly refers to users who have not yet subscribed and are exposed to advertisements while enjoying music. Unfortunately, the company’s advertising segment seems to be growing into another pillar of disappointment.

Notably, Spotify’s advertising revenue was down 27% quarter-on-quarter, and total revenue was down 4% from Q4 last year. Ad revenue can certainly be subject to quarterly seasonality. But given Spotify’s stable subscriber base, such a continuous decline is hardly acceptable. Admittedly, this doesn’t seem like a way for Spotify to be sustainable and profitable.

Are Spot Stocks a Buy, According to Analysts?

Turning to Wall Street, Spotify Technology somehow maintains a consensus rating of “buy in the middle” based on 16 buys and 7 holds allocated over the past three months. Spotify’s average share price forecast is $157.17, suggesting a 3.7% upside potential.

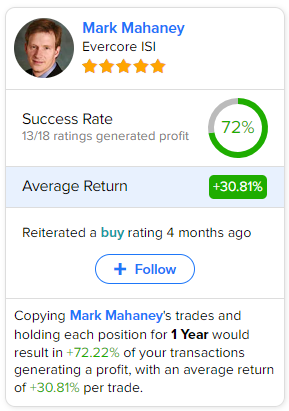

If you’re wondering which analysts to follow when trading spot stocks, the most profitable analyst covering this stock (over a one-year period) is Evercore ISI’s Mark Mahaney, with an average The return is 30.81%. The rating and success rate he has is 72%.

Take-out

In conclusion, Spotify’s current market performance appears to be driven by unfounded optimism rather than a realistic assessment of the company’s financial prospects. The core problem is that Spotify is unable to achieve profitability due to its narrow profit margins and heavy royalties paid to artists and record labels.

Even though the company has a significant user base, further expansion will be challenged if it is unable to capitalize on growing profits. Additionally, Spotify’s advertising business, which could potentially add value, has shown disappointing growth. Given these factors, investors may be wise to pay attention to Spotify’s bear market. This suggests the potential for a notable downside after the stock’s long-term rally.

Disclosure

[ad_2]

Source link