[ad_1]

Spencer Pratt

investment paper

Spotify (New York Stock Exchange: Spot) is one of the best performing stocks this year, posting a massive year-to-date gain of over 80%. And this is the main reason I wouldn’t buy at current levels, even though it’s undervalued.i think there is New declines are likely this year as adverse macro-environmental effects are very likely to occur. Moreover, many investors will realize capital gains after such a massive rise. Therefore, I assign his SPOT a ‘Hold’ rating.

Corporate information

Spotify is the world’s most popular audio streaming subscription service, with a community of 489 million monthly active users. [MAUs] The company offers both premium and ad-supported services.The company had 205 million premium subscribers by the end of 2022, according to its latest 10-K report.. SPOT is founded and headquartered in Luxembourg.

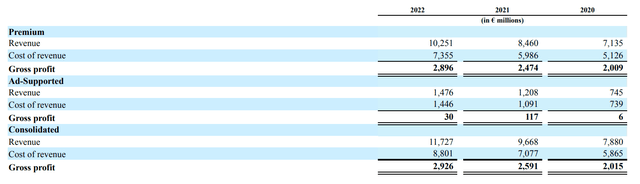

The company’s fiscal year ends on December 31st. There are two reportable segments: premium and ad-supported. Premium segment revenue is derived from subscription fees. The advertising-supported segment’s revenue is derived from the sale of advertisements. The premium division accounted for about 87% of the company’s total sales and about 99% of its total gross profit in 2022.

Spotify’s latest 10-K report

Finance

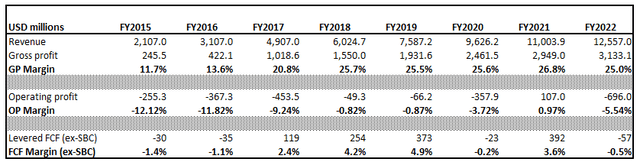

The company went public in 2018, so we only have financial information for the last eight years. I usually look at the last 10 years, but I can see the trends for the past 8 years as well. Over the past eight years, revenue has grown at a staggering CAGR of 29%. As the scale of the business expanded, the company’s gross profit increased significantly. Although the gross profit margin has been stagnant since FY2018, companies whose profit margins improve due to business expansion are favorable. Sales nearly doubled in the same period.

Author’s calculation

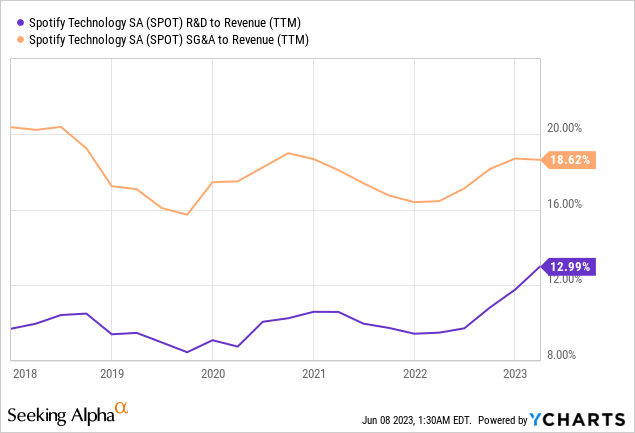

As the company invests heavily in R&D and SG&A expenses, its operating profit does not show a sustained positive trajectory.

Considering that sales increased almost 6x over the same period, I don’t like that SG&A as a percentage of sales is down by only 2%. Considering the gross margin is 25%, the ratio of SG&A to sales is very high at about 19%. I think the management team also recognizes that the company can reduce SG&A expenses and still maintain solid revenue growth. That’s why the company laid off about 6% of its workforce in January and recently announced it would cut another 2%. I see this as a positive sign for shareholders and a sign that management recognizes the need to focus on improving margins.

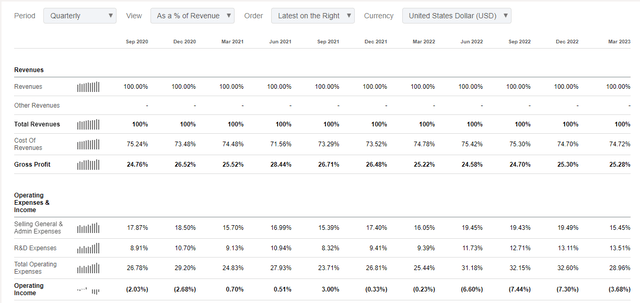

looking for alpha

As can be seen from the table above, the reduction in headcount has significantly reduced the ratio of SG&A to sales. We expect this ratio to continue to improve throughout the year as we expect the impact of layoffs to be delayed by the impact of severance pay. While net cash change in the first quarter was still negative, operating cash flow turned positive from his negative in the fourth quarter of 2022. This is a good sign that cost-cutting efforts are paying off.

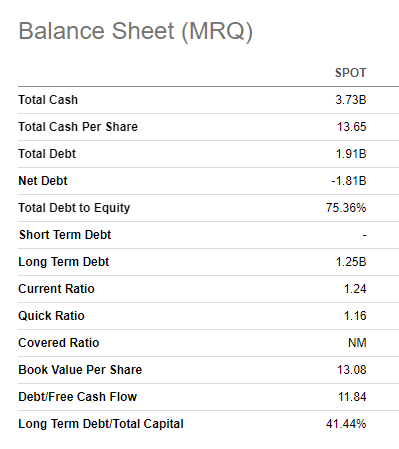

SPOT’s balance sheet is in very good shape with a solid net cash position and healthy liquidity metrics. A strong balance sheet is critical in today’s uncertain environment. Because companies can withstand multi-quarter storms.

looking for alpha

evaluation

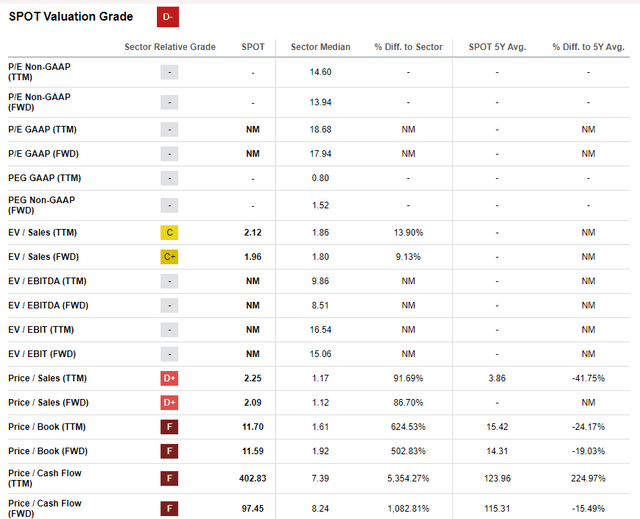

Spotify stock has posted a staggering 80% gain since the beginning of the year. The stock significantly outperformed both the overall market and the tech sector (XLK). Seeking Alpha Quant’s SPOT evaluation grade is as low as “D-“.

looking for alpha

This is mainly because Spotify’s multiple is significantly higher than the sector median. On the other hand, if you look at his five-year average valuation multiple on SPOT, it’s now pretty low. Therefore, signals from multiple analyses, are mixed, and one more approach should be used to get more confidence.

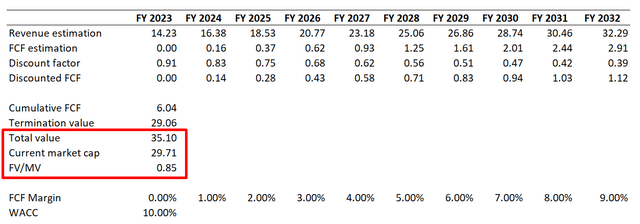

using discounted cash flow [DCF] SPOT’s evaluation approach. The company is growing aggressively, and consensus estimates put him on track for a staggering 9.5% revenue CAGR over the next decade. Based on past financial analysis, the company has not yet achieved a sustainable FCF, but we believe it will definitely reach break-even next year, expanding at least 1 percentage point annually. I think this is a very conservative assumption. We believe valueinvesting.io’s forecast of 8.2% is too low given the risks inherent in growth companies, so we use a discount rate of 10%.

Author’s calculation

As you can see from the spreadsheet above, DCF suggests that the stock is undervalued by approximately 15% and the fair value of the business is approximately $35 billion. Its current market capitalization is around $30 billion.

Overall, I think SPOT stock is undervalued given its fairly conservative assumptions. But after such a massive rally so far this year, some investors may start to realize capital gains, which will put downward pressure on the stock.

Risks to consider

The most obvious risk for Spotify, in my opinion, is that the streaming industry is significantly more competitive. As one of the pioneering platforms in the music streaming market, Spotify is experiencing rapid subscriber and user growth. However, the streaming industry is under increasing competitive pressure as a large number of new entrants enter the competition. Spotify also faces stiff competition from giants such as Apple (AAPL), Amazon (AMZN) and Google (GOOG). These giants own vast resources that Spotify is unlikely to match. To win the streaming race, they can easily start a price war and eat a large chunk of the pie at the expense of Spotify. Tech giants have far more resources, both financial and human, to bring cutting-edge features to their streaming services. I see competition as the biggest threat to Spotify’s long-term success.

As we’ve seen over the last few decades, the music industry has been in some turmoil. Audio cassettes, compact discs, and MP3 music formats enjoyed fairly short lifecycles as each destroyed the previous format. And Apple, the “father” of the audio streaming industry, created disruptive iTunes. And all this turmoil has happened in the last 30 years. Therefore, the audio streaming lifecycle can be shortened as well.

Finally, Spotify’s current market capitalization comes at the cost of massive revenue growth and rapid profit growth. Failure to achieve the expected pace of revenue growth or an inability to effectively manage profitability as the scale of the business increases will result in a reduction in the price target. This risk is inherent in all growth companies, especially those that have not yet achieved sustainable profitability.

Conclusion

I am not buying any stock and giving it a neutral rating. I do so because, despite the attractive valuations, many investors are likely to start realizing capital gains after their massive rally so far this year. I also think it’s very likely that external shocks in the broader environment will weigh on stocks, especially growth stocks like SPOT.

[ad_2]

Source link