[ad_1]

Imaginema

Our previous article on Whitestone REIT (New York Stock Exchange: WSR), concluded that the company deserves your conditional support given its well-defined procedures for righting past wrongs. I think we are still on the same page. The reason I think so is that I was able to successfully conduct an interview with Whitestone CEO Dave Holeman. So I was given the opportunity to present him with some of my thoughts and skepticism about the company’s prospects.

—–Begin interview—–

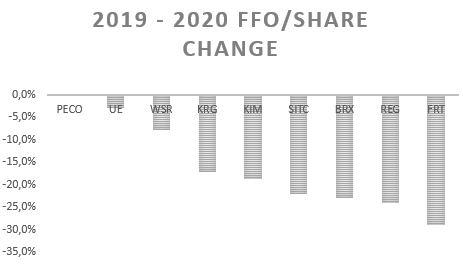

Q: Retail REITs have been found to be more exposed to market downturns and downside earnings risks than other REIT types.Within the retail REIT universe, groceries take center stage – REITs are considered To become a more resilient submarket. On the contrary, 24% of WSR’s lease income comes from companies operating in the restaurant and food service sector, which is positively correlated with general economic market downturns. Does the company have plans to gradually move to more resilient retail submarkets, or at least reduce its concentration in certain retail sectors to some extent? A: Whitestone’s non-grocery fixed center has been doing very well over the last few years. This is because people stay closer to home and frequent local centers, especially in high-income areas. We also see evidence that restaurants are major competitors to grocery stores. Looking at Covid-19, the biggest stress test REITs have faced since the financial crisis, Whitestone was near the top of its peers in declining FFO/share. FFO/Share fell from $0.90 in 2019 to $0.83 in 2020, or about 8%. This is near the top of his peers, and nearly half of his peers have seen his FFO/share drop over 20%. While many of their peers still haven’t caught up with their collection in 2022, Whitestone had few collection issues. In fact, it was in the rearview mirror halfway through 2021. Many peers released his 2023 adjusted SS NOI growth numbers, as 2022 starting numbers were still being pushed by collection catch-up.

FFO/share volatility (various financial reports)

We believe there are other important factors that provide resilience, which is why our performance has improved. B) Being able to work closely with tenants and not having huge national chains (offices across the country often prevented rents from being paid evenly, which has not happened in local businesses) ). C) Being located in Texas and Arizona where shutdowns due to the pandemic have been minimal. All of this is not to say we don’t like grocery stores. They’re an important part of our mix. too much.

Q: As the Fed seeks to keep inflation in check, it has launched a series of rate hikes aimed at slowing the economy. But no one knows how much is too much. WSR’s exposure in the financial services sector is 8% of ABR. Do you have any plans to move forward with it? A: We believe our current exposure to financial services is a good fit for our center. This is partly because our market is growing at a high level. Frost Bank represents approximately 25% of our financial services. Below are comments regarding the Houston operations on the fourth quarter 2022 earnings call. In terms of branch expansion efforts, the initial 25 Houston expansion branch deposits exceeded his $1 billion and continue to exceed pro forma. Loans totaled $727 million at the end of the year, including additional branches that it opened in what it calls Houston Expansion 2.0. At the end of the year, we hit 114% of our household goal, 170% of our loan goal, and 104% of our deposit goal, and we continue to add new locations to our strong neighborhoods. ”

Q: The company’s 2022 report states that 14.6% of WSR’s ABR will expire this year, and another 16.7% will expire in 2024. Given the expected economic slowdown, do you think the timing is right? Do you expect these lease renewals to increase NOI and average rent per square foot? Have you expressed a preliminary intention to update the A: With a renewal rate of 16.5% in 2022, we continue to see very high lease spreads. In addition, her COO of the Company, Christine Mastandrea, commented that the environment remained strong during the company’s earnings call earlier this month. We actively engage with the entire tenant base when updates are made. That is, we have tenants who are intent on leasing and are actively renewing.

Q: Looking at WSR’s debt profile, we see that, despite being relatively highly leveraged, most of the company’s debt is fixed rate and exempt from the company’s unsecured lines of credit. In our last earnings call, we said that a 100bp increase in SOFR would create a $0.02 difference in his expected FFO/share. Are the recent rate hikes in line with his FFO guidance assumptions for 2023? A: The $0.023 FFO/equity difference associated with the 100bp SOFR curve move is as of March 1, 2023. Since then, the curve has dipped slightly, so we shouldn’t expect any impact on guidance beyond the call.

Q: Based on your monthly dividend payout of $0.04 per share, and the midpoint FFO guidance of $0.97 for 2023, WSR will pay almost 50% of your annual FFO. What is WSR’s priority for the remaining 50%? A: Our top priority is to reduce leverage. That doesn’t necessarily preclude property retrieval. The Lake Woodlands acquisition had a 7% cap rate and a short-term lease upside. Therefore, it is possible to make acquisitions that increase FFO/equity at the same time while improving the leverage metric. You just have to choose.

Q: Regarding WSR’s ongoing ATM programs and shelf offerings, do you plan to run them to raise cash in 2023? If yes, to what extent? A: At current stock prices, it is very difficult to use ATMs to increase FFO/equity while reducing leverage.

Q: The occupancy rate is clearly trending positively. Do you see this trend continuing in the first quarter of this year so far? A: We certainly expect to maintain a high operating rate. We forecast 93.5% to 94.5% in 2023. However, recycling will play a bigger role in 2023. Christine said on her earnings call: “We believe we still have a long way to go in terms of improving occupancy rates, but in 2023 the focus will be on remanufacturing, so existing store NOI will be a major driver of future growth. ”

Q: Regarding the annual rent increase rate, is it still around 3%? Are you considering the rent increase? A: The rent increase is slightly higher than last year, so I think it’s 3-4%. But the real key to rent growth is having a thriving business as a tenant. In addition, the lease term is intentionally shortened. The short lease term is a real benefit when placing the right business in the centre.

—-End of interview—-

Conclusion

Based on the responses above, I continue to view Whitestone REIT as an interesting potential investment in the retail real estate sector. As the company moves towards reducing costs and leverage while supporting FFO, we see a turnaround story here. With a very reasonable dividend yield, Whitestone now balances short-term and long-term rewards for shareholders in terms of income and value.

[ad_2]

Source link